Hi everyone and Happy New Year. This is Shahid, a realtor from Maximum One Realty Atlanta. Today, we're talking about homestead exemption. I'm doing this video for the new year because it's 2019 and a lot of people, including my clients, have purchased homes in 2018. Now, it's time to apply for the homestead exemption to ensure it affects their 2019 property taxes. So, what is a homestead exemption? It's basically an exemption that the state and county give you to reduce your property tax liability. Instead of assessing your house at a hundred thousand, for example, they may assess it at ninety thousand because you've declared your home as your homestead. This exemption is only applicable to your primary residence, not rental or investment properties. However, it's always a good idea to check with your local county for your specific situation. To apply for the homestead exemption, some counties allow you to do it online through your county tax commissioner or assessor's office. Other counties may require you to fill out paperwork and submit it in person. Generally, larger counties have the option to apply online. Now, let's talk about additional exemptions available to homeowners. Apart from the standard homestead exemption, some counties offer special exemptions for seniors. These exemptions can include not having to pay the school portion of taxes or freezing your taxes so they don't increase as you age. It's crucial to take advantage of these exemptions as you get older. Remember, applying for the homestead exemption doesn't automatically make you eligible for other exemptions. You have to reapply for them. If you already have your homestead exemption, I encourage you to check on your grandparents, great-grandparents, or parents to see if they are receiving the senior exemption they are entitled to. It's essential to ensure they are taking advantage...

Award-winning PDF software

Sr13 Georgia Form: What You Should Know

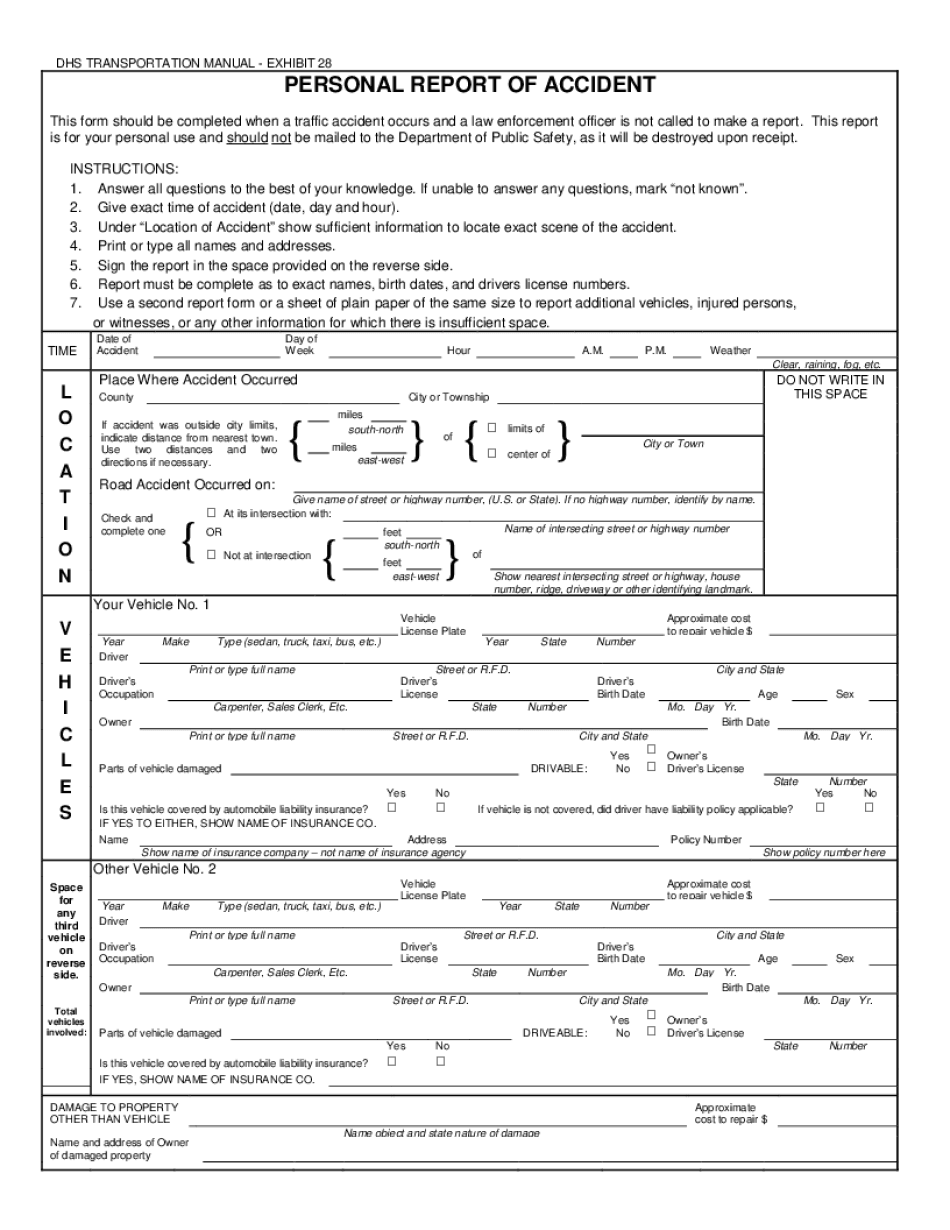

This report may be used by the responsible party or his/her insurer to determine a claim and by insurance companies to prove their insurance policy is proper. In any case, this information may not be shared with anyone. Download it for FREE in Adobe Acrobat (PDF, 9.4 MB) format. Georgia Law: SR 13 Personal Accident Report Form Accident Report / SR-13 Form (Personal Report Form) — Georgia Online Form This page is a collection of Georgia SR 13 forms (Accident Reports) in Adobe Acrobat format by Burrow & Associates. These SR 13 Personal Accident Forms are perfect for accident victims looking to take advantage of the state's SR-13 Personal Accident Report. You can read, print, fill and send a SR-13 Personal Accident Report form online. Get Your SR-13 & Pay Your Fees in Georgia Online Your accident report will be processed after you complete the following steps as explained by your agent. Fill out the Free Personal Accident Report Georgia Online Form Get Started With Your Personal Report Form In this section you will find instructions for: 1. Complete the registration of your vehicle. 2. Upload your information to the State of Georgia SR-13 form. 3. Complete an SR-13 accident report. The personal accident report must be done in person, not by e-mail, nor by posting the report online. You will only need a valid Georgia driver's license to submit this report to the Georgia Division of Records or to receive a 22 bill from SRF. Please call your auto insurance agent to confirm the date of your accident. Online Personal Accident Report Forms Georgia, TX and AZ Personal Accident Report: Florida Georgia Driver's License For Georgia: If the driver is a Georgia resident, his/her Georgia driver's license must be presented to the traffic officer at the scene. If the driver is from another state, the officer may accept the license as proof of identity, but if the driver does not present the driver's license at the accident, it will not be accepted as evidence of identity. In this situation you must have proof that you are the driver (e.g. a recent credit card bill). If a driver does not present a recent credit card statement or bank statement, he/she may not be able to complete this report.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Georgia Sr 13 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Georgia Sr 13 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Georgia Sr 13 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Georgia Sr 13 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sr13 Georgia form