If you have been involved in an automobile accident, you are probably familiar with a police accident report. This report contains various numbers on each margin and at the bottom, which are codes that explain what the police believe happened and who was at fault in the accident. However, these codes may seem meaningless without access to the motor vehicle accident codes chart. To determine the accuracy of the report, it is crucial to carefully examine the chart. Often, you might discover an inaccurate or incorrect description of the events and fault. Therefore, it is essential to obtain the police accident report as soon as it becomes available and present it to an attorney. Any errors or omissions can be addressed and corrected by contacting the police department. Acting promptly is crucial, as the details of the incident are still fresh in the officer's mind. It is essential to present any available documentation that supports your position. If wrongly deemed at fault and sued, it could have severe financial implications. Additionally, your insurance rates may increase as a consequence. If you have been involved in a motor vehicle accident, we offer a free in-person consultation. Feel free to give us a call. Music you Music.

Award-winning PDF software

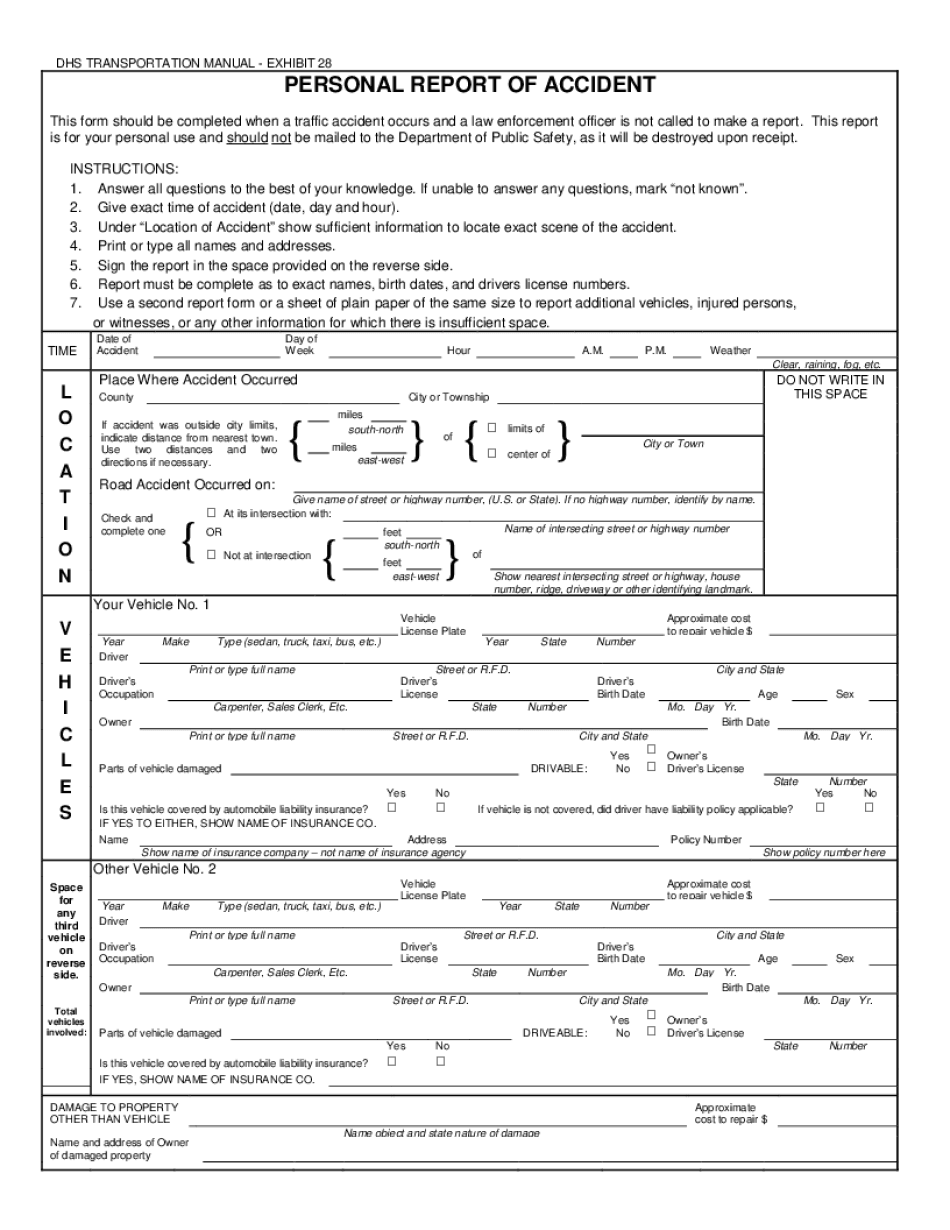

Nj self reporting accident Form: What You Should Know

In this section you will be provided with information you need to submit your inquiry regarding an accident or crash. The vehicle information is based on the information you entered into the New Jersey Self-Reporting Crash and Investigation form. This form is available at the New Jersey State Police Traffic Records Unit at: Request or Obtain a Report or Information About Accidents — SECTION B. Crash and Injury Reports. Reportable Accidents / Crashes : A. All Accidents / Crashes that are Reportable. As defined by the Motor Vehicle Division, the following are reportable and must be reported within the timeframes established by the New Jersey State Police, which is one year to ten years (ineligibility for payment of damages and/or other penalties): Any injury or death to any person (unless the injury or death was due to the willful misconduct of the insured or other insured's negligence); Any loss of property of any kind; Any property damage not caused by the insured's negligence; Any collision damage; Any loss or damage due to theft or vandalism not caused by the insured or other insured's negligence; Any bodily injury sustained in an accident resulting in personal injury; Any property damage resulting from an accident resulting in property damage to the non-insured person's (non-insured motorist) vehicle or personal property; Collisions with property other than other vehicles or public property; b. Accidents resulting solely from the negligence of the vehicle owner. C. All Injury and Death Accidents : Any Injury or Death resulting from an accident which is not a reportable accident or which is not reported to the New Jersey State Police. D. All Property Damage Accidents : Any Property Damage resulting from an accident that is not a reportable accident or which is not reported to the New Jersey State Police. SECTION C. The New Jersey Self-Reporting Crash and Investigation Form. § 23-b. Report of Accidents and Losses. A. The following is information to be supplied to the New Jersey State Police when requesting to report an accident or injury: Vehicle information.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Georgia Sr 13 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Georgia Sr 13 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Georgia Sr 13 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Georgia Sr 13 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nj Self Reporting Accident Form